News

Too little too late for Jet Airways?

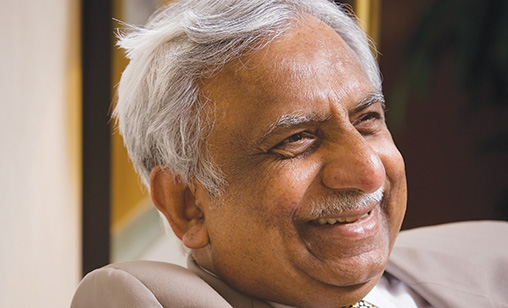

The survival of India’s Jet Airways is hanging in the balance as efforts to keep it flying stumble. Founder and chairman Naresh Goyal and his wife have been forced off the board, but they were only part of the problem reports associate editor and chief correspondent, Tom Ballantyne.

April 1st 2019

When Naresh Goyal, who founded Jet Airways 25 years ago, bowed to pressure and stepped down from the airline’s board on March 25 it was a breakthrough in the complicated and often chaotic efforts being made to keep the full service carrier alive. Read More »

His coerced resignation and the reduction in his shareholding had been an insistent demand of potential rescuers of the carrier including Abu Dhabi’s Etihad Airways. But nothing happens quickly in India and the once market-leading carrier, drowning in more than US$1 billion in debt, can’t seem to find a solution to its woes.

|

With Goyal and also his wife, Anita, now without influence at the Mumbai headquartered carrier, the State Bank of India, the lead creditor of the airline, is to appoint an interim management team to run Jet.

The banks have agreed to swap just one rupee of debt for 114 million shares in Jet Airways, which gives them control. The banks have agreed to provide immediate funding of $218 million while they prepare to bring new investors onboard, a process the airline said should be completed by June.

“We believe it is in the lenders’ interest, it is in the country’s interest and the aviation sector’s interest that Jet Airways continues to fly,” State Bank of India chairman, Rajnish Kumar, told local media.

However there is still a problem - finding a new partner prepared to invest in a near bankrupt airline. Etihad, already holding 24% equity in Jet, was seen as a potential saviour, but it appears to have cold feet.

Under a potential deal, Etihad was expected to invest between $295 million to $350 million in the airline on the understanding Goyal would reduce his equity and resign as chairman.

Goyal has gone but in the meantime the Abu Dhabi carrier has reported a loss of $1.28 billion for its latest year, following a $1.52 billion loss twelve months earlier: a total of $2.8 billion of red ink in 24 months.

|

After being badly burnt by its investments in Air Berlin and Italy’s Alitalia, will Etihad still decide to increase its investment in such a high risk venture as Jet? At press time, Abu Dhabi had not said if it would stay or go with Jet, especially as other factors had to be taken into account.

Flying operations are not going well. Approximately two thirds of of 124-strong fleet has been grounded because of late lease payments. Jet has cancelled all flights to and from Abu Dhabi, the headquarters of Etihad. The carrier’s pilots are ready to strike because they are not being paid and the airline’s share price has plummeted, standing at a quarter of its value of a year ago.

An unlikely White Knight is the Narendra Modi government. It came to power on a platform of supporting businesses such as airlines and it is now facing re-election. In such charged political times, it cannot afford to have a major airline collapse. Should it step in and bail Jet out, especially as it is trying to free itself from ownership of bankrupt flag carrier Air India?

Whatever happens, Jet faces another trying year in Indian and international skies. Increasing competition from LCCs, a weak rupee and highly taxed aviation fuel won’t allow it to turn any financial corners soon.

Anyone who knows anything about India’s airline market is aware the chances of Jet’s survival are fading by the minute. Few of the informed in the industry are willing to wager money on its survival.