News

IATA forecasts cash reserves of many airlines will run dry in three months if COVID-19 continues to decimate passenger traffic

March 20th 2020

International Air Transport Association (IATA) figures show airlines in the Asia-Pacific were among some of the better placed to withstand the financial squeeze amid slumping demand for air travel. Read More »

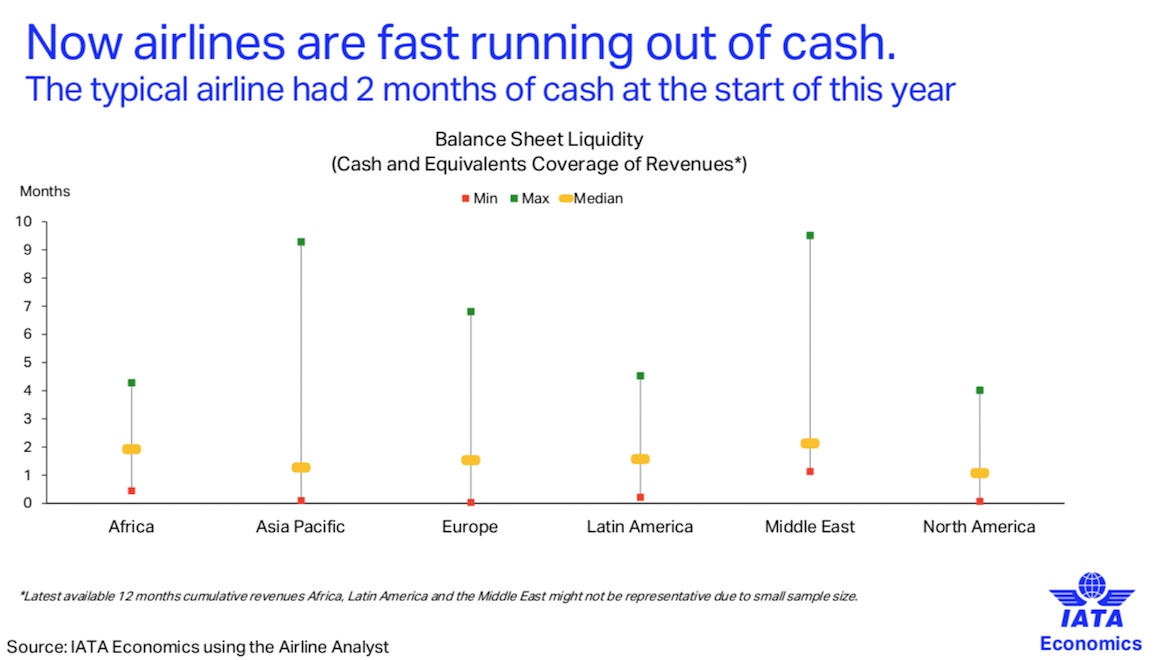

A presentation from IATA chief economist, Brian Pearce, showed about 75% of airlines had less than three months worth of cash to cover unavoidable fixed costs as the coronavirus pandemic crippled demand for air travel.

"Airlines are fast running out of cash," Pearce said in a slide presentation shared with reporters on March 17.

"Outside the top 30 balance sheets debt levels are high, so many airlines will have fixed obligations of debt to service and repay.

“There are a number of airlines that have cash to weather this but the majority are in a vulnerable place.”

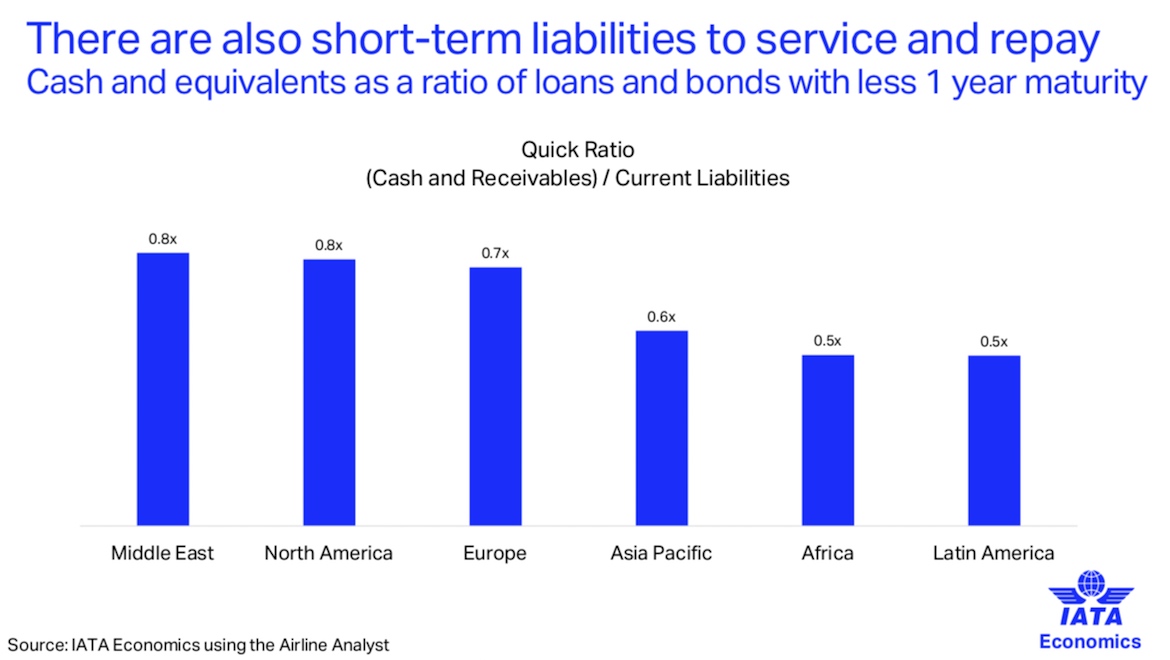

Pearce's slide presentation showed Asia-Pacific carriers had a ratio of cash and receivables to current liabilities of 0.6 times, which was the second lowest behind Africa and Latin America at 0.5 times. North American and Middle East carriers were at 0.8 times, with Europe at 0.7 times.

IATA's analysis of balance sheet liquidity showed some Asia-Pacific airlines had up to nine months cash and equivalents to ride out the current crisis, with the median at between one and two months.

The global spread of the coronavirus, also known as COVID-19 that began in Wuhan in central China in late 2019 has led to sweeping travel restrictions by national governments that have essentially closed many markets to air travel.

The virus has infected more than 230,000 people and killed more than 10,000.

IATA figures noted the number of markets with more than 10 cases covered 94% of global passenger revenues.

In early March, IATA estimated the COVID-19 pandemic would cause global revenues for airlines to fall by up to US$113 billion in calendar 2020, based on an "extensive spread" of the disease.

However, those predications from a fortnight ago were now out of date give the situation had "moved beyond" its extensive spread scenario, IATA said.

As a consequence, IATA believed the global airline industry would need up to US$200 billion in government support through measures such as direct financial aid, loan guarantees and tax relief.

And there was little time to lose, IATA director general, Alexandre de Juniac, said.

"There is no one size fits all solution," de Juniac said. "So, we will be writing to governments around the world to alert them to the dire situation of the industry and get them moving – in the circumstances of their country.

"Time is of the essence. Governments cannot take a wait-and-see approach. We have seen how dramatically the situation has deteriorated globally in a very short time. They must act now and decisively."

Ratings agency, S&P Global Ratings, said this week there had been an unprecedented plunge in air traffic demand in recent weeks.

Further, it said controlling the coronavirus outbreak and establishing passenger confidence may be more challenging and take longer than after SARS in 2003 or swine flu in 2009.

"Hence, our current base case for global air passengers in 2020 assumes a decline of 20% to 30% from 2019, with full recovery achieved only in 2022-2023," S&P Global Ratings analysts said in a research note dated March 17. "We recognise, however, that the situation is highly uncertain and fast-moving.”

"Considering likely weaker macroeconomic conditions globally and the debilitated competitive positions of airlines emerging from the pandemic, we assume air traffic could remain depressed over a six-month period (albeit with a partial recovery after a three-month peak drop), while full recovery is likely to be gradual in the 24 months following the containment of the virus."

Respected aviation analysis website, Leeham News and Analysis, said its review of the balance sheets of airlines worldwide showed U. S. carriers had "plenty of time for demand to recover".

While American Airlines, Delta Air Lines and United had fewer than 90 days of cash on hand, including credit lines, Leeham News and Analysis noted the so-called U.S. big three each had between US$10 billion and US$20 billion in unencumbered assets such as aircraft and landing slots.

"Selling these or using them as loan collateral could extend each airline’s respective runway out to 150-280 days," the Leeham News and Analysis research dated March 16 said.

"American, Delta and United announced dramatic capacity cuts that will buy them additional time. Other carriers will undoubtedly follow. These reductions will materially extend the amount of time each airline can last without running out of cash."

It noted the days’ cash estimates were “highly conservative".

|

|