Main Story

Starting over at MAS

It has been the worst year imaginable for Malaysia Airlines (MAS) chief executive, Ahmad Jauhari Yahya, and his airline. But he made it clear at the recent annual assembly of the Association of Asia Pacific Airlines (AAPA) that the carrier will survive this year of tragedy and financial stress.

December 1st 2014

Corporate introspection has been the name of the game at Malaysian Airlines (MAS) this year. Said the carrier’s CEO, Ahmad Jauhari Yahya, at a leading industry gathering in November: “the incidents we had in 2014 caused us to take a very hard look at what we are doing, what we did in past years and what we need to do as we move forward.” Read More »

Speaking as a member of the airline executive panel at the AAPA Assembly of Presidents in Tokyo, he continued: “We don’t just have two competitors on many of the routes we fly, but five or six. So it puts a lot of pressure on you as an organization, especially an organization that has been around for 40 years. A lot of that has to be revised in order to meet new challenges.”

MAS is now in the process of becoming wholly-owned by Malaysian government sovereign wealth fund, Khazanah Nasional, and will soon be de-listed from the nation’s stock exchange. The flag carrier is undertaking a major restructuring that will be supported by a $1.4 billion capital injection from the government backed fund. Some 6,000 jobs, or 30% of MAS’s workforce, will be depart from the airline. There will be a major adjustment of its fleet and network which will be underpinned by a new focus on regional flying.

At press time, MAS confirmed industry rumours that the CEO of Aer Lingus, Christoph Mueller, is the man the airline wanted for the job. Mueller’s contract with the Irish airline expires next year and Mueller has announced he will be moving on. He will be MAS CEO-designate from January 1.

In the meantime, Yahya is tackling the enormous challenges that confront an airline in a Southeast Asian market that has altered irrevocably in the last decade. The region has become one of the world’s most competitive airline arenas as both rapidly expanding budget carriers and increased legacy carrier competition from the Gulf and Europe vie for passenger business.

“How do you cope with the barrage of LCCs coming through KLIA? We just have to respond on equal terms. Operating out of Kuala Lumpur is probably one of the best run low-cost airlines in the region (AirAsia). We have no choice but to respond,” he said.

|

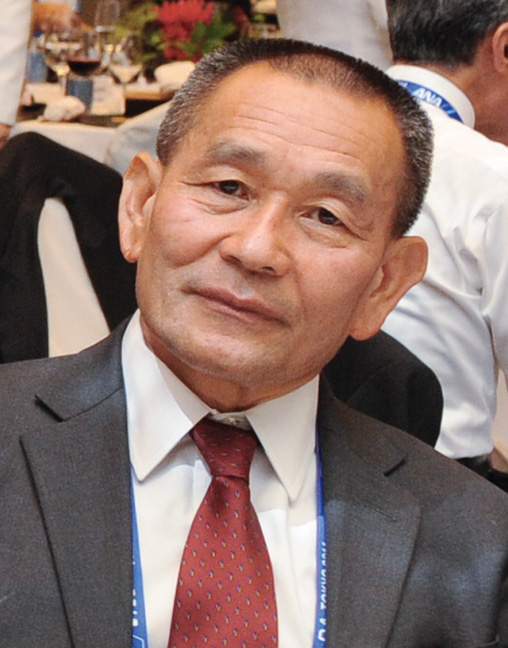

| MAS CEO, Ahmad Jauhari Yahya: MAS must meet the new challenges |

The MAS CEO said competition from the Gulf carriers and budget airlines has put a lot of pressure on the carrier’s costs. But what was “more important was customer behavior”. “Customers who like to fly with us have evolved. We have growth of 5% to 10% a year, but that growth is not necessarily on the premium side.

“Growth is in the value side. How do you address that? We have been a bit slow and we just need to move faster,” he said.

With his airline headquartered in Kuala Lumpur, the heart of the LCC explosion, Yahya agreed with one of the main themes of the Tokyo gathering: that the lines had blurred between full-service airlines and LCCs, or hybrids.

“I do see a strong blurring between low cost and premium. Low-cost is trying to act like premium and premium is trying to act like low-cost.

“We are also are talking [at least] to our own government to ensure they provide us with the necessary infrastructure to compete on an equal basis,” he said.

“An airline is an airline. The government can’t differentiate. It can’t decide an airline is a low-cost carrier and provide it with beneficial charges. That’s a debate that’s going on right now.”

With MH370 still to be found after it disappeared on March 8 this year, MAS is attempting to rebuild its market in China as many of the passengers aboard the lost aircraft were from the Mainland. Yahya said the business in China had contributed “some 10% of the airline’s revenue” before the MH370 loss. This business stream was almost completely wiped out after MH370 went missing.

“Only time allows us to actually move on after these incidents. There are pockets of recovery, but all in all we are still down on traffic in China,” he said.

As for the coming year, Yahya forecast that the major challenge would be “to consolidate and then look at strengthening what MAS does well while dealing with rivals’ greater penetration of the region’s market. “We do expect more capacity will be thrown in the mix from the U.S. and the Gulf,” he said.