Main Story

Dark days

What’s next for the global aerospace industry after the U.S. imposed tariffs of 145% on Chinese imports and then back flipped, for the second time, by delaying enforcement. Associate editor and chief correspondent, Tom Ballantyne, reports.

April 1st 2025

U.S. president Donald Trump may have hit the pause button for a second time on tariffs on imports from dozens of countries, particularly China, but the threat to global aviation is far from over. Read More » Only weeks after the U.S. president unveiled his “Liberation Day” tariffs, U.S. treasury secretary, Scott Bessent, was telling a closed door briefing for influential investors the standoff with China was “unsustainable”. At the same time, the U.S president’s media team was leaking like a sieve that the U.S. president expected the impasse to begin unwinding by mid-May.

It did. On May 12, in a second 90-day pause and after a weekend of talks between the U.S. and China in Geneva, the U.S. slashed tariffs to 30% for 90 days on Mainland goods imported to the U.S.

|

It was a capitulation on the part of the White House leadership and a win for China in the mega power trade war.

At press time, China was the good guy but for the global aerospace industry many manufacturing dilemmas are far from being resolved.

Close to the start of the Trade War standoff between the two countries, China’s president, Xi Jinping, ordered China’s airlines to refuse to accept Boeing jet deliveries. Within the day, two Boeing aircraft bound for Mainland customers returned to Seattle from China.

Boeing CEO, Kelly Ortberg, said the China customers had declined to accept three jets they had ordered. Fifty more Boeing airplanes are due to be delivered to China this year, Ortberg said.

At the same time, GE Aerospace is considering a “tariff surcharge” estimated at US$800 million -for at least a year -if high U.S. tariffs remain in place.

RTX said its surcharge, although it did not label it as such, would be US$850 million and be distributed equally with its two major aerospace companies, Collins and Pratt & Whitney.

For China, the Trump tariffs open up the market for COMAC’s C919 powered by CFM engines. To complicate the new era of U.S. tariffs on trading partners, CFM is a Safran (French) and a GE (U.S.) joint venture.

There are three Final Assembly Lines for production of CFM engines: GE Aerospace in Lafayette and Durham in the U.S. and the Safran Aircraft Engines facility in Villaroche, France.

LEAP-1A engines for Airbus aircraft are assembled in France and the U.S. plants are responsible for their LEAP-1B counterparts.

|

A similar arrangement applies to the CFM56.

Villaroche also assembles COMAC’s C919 LEAP-1C engines, but a significant number of its components, including avionics, are imported from U.S. companies. The U.S. tariffs will add significant cost to the manufacturing of both aircraft types.

As reported in Orient Aviation Daily Digest, any China retaliatory tariffs will significantly increase the cost of Boeing aircraft for Chinese airlines, potentially requiring them to adjust their fleet procurement strategies.

“The tariff hike will impose massive extra costs on Chinese carriers planning to acquire U.S. manufactured aircraft,” the Yicai Global news platform reported.

Industry analysts believe Mainland domestic airlines are likely to seek alternative suppliers or delay purchases to mitigate the impact of the U.S. tariffs, 90-day pause or not.

In the short-term, carriers may prioritize leased jets over direct purchases. Longer term, they could shift to ordering Airbus or COMAC aircraft, Yicai wrote.

Overall, industry analysts said the Trump tariffs could cost aviation in excess of $5 billion a year.

And the forecast does not include global volatility that has yet to stabilize. Within hours of Trump’s ‘Liberation Day’ tariff announcement, trillions of dollars were erased from global stock markets and resulted in an unsettling surge in U.S. government bond yields.

Luckily, the rout caught Trump’s attention and he began to walk back from the immediate imposition of the staggering tariffs.

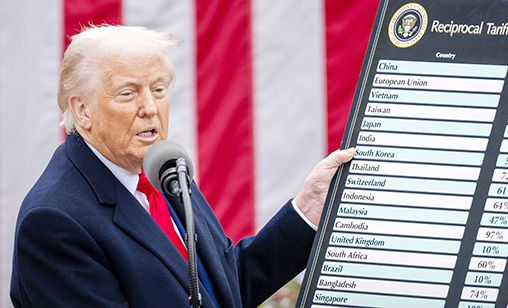

At the time, which seems eons ago, Trump’s Liberation Day tariff blitz included Vietnam (46%), Japan (46%), Taiwan (32%), South Korea (25%), Cambodia (49%) and Europe (20%).

|

| Sources: Boeing, Reuters |

If the tariffs, though reduced, are imposed after the U.S.’s second May 12 90-day pause expires, aircraft, engines and their components will cost more, raising prices airlines have to pay their suppliers and increasing air fares because the higher costs will be passed on to passengers.

This cycle can make life very difficult for airline planning and also ripple through complex global supply chains that are still recovering from the pandemic.

France’s aerospace lobby GIFAS - Groupement de Industries Francaises Aeronotiques et Spatiales - has called on the European Union (EU) to react with “proportionate and assertive” countermeasures” against the Trump tariffs but also advises caution, given how tightly interwoven U.S. and European aerospace manufacturing has become over the decades.

Initially, the EU reacted to Trump by imposing 25% tariffs on U.S. goods. But like Trump, it later paused retaliation.

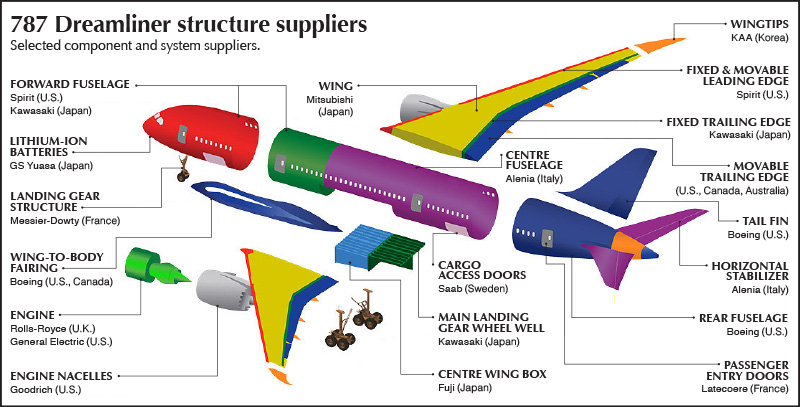

Rolls-Royce, Safran, GE Aerospace, Pratt & Whitney and MTU all depend on trans-Atlantic cooperation. Boeing and Airbus rely on each other’s supply chains and deliver aircraft across borders. CFM International powers thousands of aircraft worldwide.

U.S. engine manufacturer, Pratt & Whitney, has more than 400 suppliers in North America, Asia and Europe. With the engines they are supplying facing significant tariffs on parts imported into the U.S. the cost of producing an engine will increase.

The same threatened price increase applies to aircraft manufacturers such as Boeing, which relies on complex global supply chains and suppliers spread across the globe to produce each of its aircraft.

At its AGM in mid-April, Airbus confirmed its 2025 production guidance but acknowledged the impact of rising global trade tensions is being evaluated by the group.

Airbus CEO, Guillaume Faury, emphasized four key points in his address to shareholders:

• Airbus is working with its supply chain, customers and plants to re-assess the implications of the tariffs on costs, deliveries and demand.

• Airbus has 20-25 undelivered aircraft – “gliders” awaiting engines primarily because of CFM delays.

• Airbus continues to face supply issues for major fuselage and wing components from SpiritAeroSystems particularly affecting its A350 and A220 programs.

• A deal for Airbus to take over selected SpiritAeroSystems sites is expected to be completed by June 30. Co-ordination is underway with Boeing to avoid disruption.

Airbus added the tariffs were not included in its February forecast and the evolving trade landscape could require adjustment.

“It is still unclear how tariffs will affect aircraft production as we have yet to see reciprocity from other countries or carve outs for aviation,” Airbus said.

“It could potentially be very messy as aircraft and MROs rely on the global supply chain network,” IBA chief economist, Dr Stuart Hatcher, said: “The supply chain is strained enough without added cost worries or the threat of dwindling demand. While it only applies tariffs to imports, who is to say other countries won’t respond aggressively such that multiple charges are applied to Boeing aircraft containing non-U.S. parts?”

“One charge is levied by the U.S. government for the part imported and another applied by the customer’s government for the final aircraft.”

The duties will up end nearly half a century of mostly duty-free aerospace trade and are set to drive up the cost of Boeing and Airbus planes, GE Aerospace engines and hundreds of other aerospace products, threatening an industry that helps soften the U.S. trade deficit by more than $100 billion a year.

“It will certainly make things more expensive for the industry,” said Aerospace Industries Association vice president international affairs, Dak Hardwick. The association represents Boeing, GE Aerospace, Airbus and dozens of other aerospace and defence companies.

The industry group is asking the Trump administration to uphold provisions in a near half century old trade agreement that allows for duty free trade of civilian aircraft and imports tied to defence and national security.

IBA’s Hatcher said there are likely options to bypass certain aspects of the tariffs and new completion centres could pop up to handle interiors along with a wider use of leased engines for deliveries.

“Regardless, the increased cost of imported goods into the U.S. is forecast to limit options and keep inflation high. Replacing them with a U.S. alternative will make it even more expensive,” he said.

“So, more inflation, a weaker growth outlook and a drop off in inbound traffic may curb enthusiasm for new aircraft deliveries for U.S. airlines.

“But to be clear, I remain bullish on aircraft production until I see where this is all going.”

Michael Davenport says:

July 6th 2025 03:20pm