News Backgrounder

Japan Airlines emerges from banker protection

It seemed unimaginable at the time, but in January 2010, Japan Airlines (JAL) filed for bankruptcy protection and requested a government bailout to keep flying. Seven years later, the flag carrier has emerged from government supervision and is racing to win back lost market share from its nimble rivals.

May 1st 2017

On the face of it, when Japan Airlines (JAL) flew its first Tokyo Haneda – New York service on April 1, the destination appeared to be no more than a smart expansion onto a key global route. Read More » But for JAL it was a very significant day in its operating history. Finally it was free of seven years of restrictions attached to the multi-billion bailout the carrier received from the government.

On that day in January 2010, Japan was rocked by the news that one of the country’s iconic businesses had filed for the largest non-financial bankruptcy petition in the nation’s history. The consequent negotiations for government support required the carrier to embark on a painful restructuring that saw thousands of jobs disappear and expansion contained at the airline and its affiliated companies.

|

Restrictions imposed on JAL included curtailed ability to launch destinations and allocation of fewer slots than its arch rival, All Nippon Airways (ANA), at Tokyo’s popular near down town Haneda airport.

As a result, ANA has had a full service carrier monopoly on the lucrative route for several years. It capitalized on JAL’s setback by rapidly expanding its international network. In 2015, almost 30 years after it commenced international services, ANA overtook JAL in the number of international passengers carried.

Freed from the government’s Enterprise Turnaround Initiative Corporation supervision, JAL must expand its international network in its battle with its nimble international rival.

After its bankruptcy filing, JAL outperformed its initial goals for recovery when its shares were re-listed on the Tokyo Stock Exchange in September 2012. But Japan’s transport bureaucrats stipulated the airline must continue to be supervised by the state because it had received generous public support that could distort the market. It also required JAL to repay several government loans before it could return to operations as an independent corporate entity.

Last January, Japan’s transport minister, Keiichi Ishii, said the government’s supervision had achieved its purpose. “Through the allocations of new takeoff and landing slots, a sound competitive environment has been ensured.”

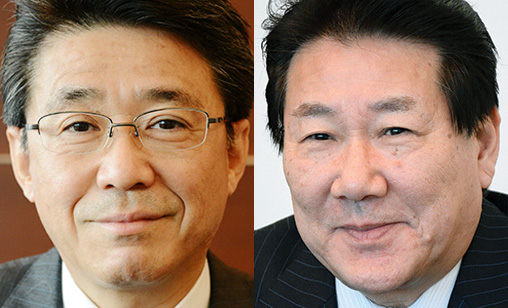

ANA does not agree. It continues to argue against financial protection JAL has received and said it does not believe the latest development changes this situation. “We can’t say the competitive environment has been corrected,” said ANA HOLDINGS president and CEO, Shinya Katanozaka.

In the meantime, JAL and ANA have become two of the most profitable airlines in Asia. After doubling its profit to $722 million in its last fiscal year, ANA reported a net profit of $890 million for the current year, to March 31.

JAL reported a drop in net profit this year after booking a 17% profit rise a year earlier. While lower fuel costs and increased visitors to Japan have fueled both airlines profitability, JAL is far ahead in earnings.

And that, ANA argued, is because of the benefits JAL has exclusively enjoyed, including reduced corporate taxes and lighter depreciation charges. ANA executives said JAL “receives a boost of some 100 billion yen a year and the cumulative impact amounts to, perhaps not one trillion yen, but hundreds of billions of yen”.

JAL is expected to invest its profits in network expansion. The carrier’s midterm management plan will highlight a “scenario for constant growth”, JAL president, Yoshiharu Ueki said.

Both airlines can look forward to a surge in business from the 2020 Olympic Games, which will be held in Tokyo. Japan’s transport ministry is considering an increase in daily round trip flights at Haneda to around 53 in the run-up to the games. These slots are highly sought after, not only by ANA and JAL, but by smaller carriers, particularly Japan’s fast-growing budget airlines.