News

Does Cathay Pacific need a second transformation?

March 15th 2019

Airline may be reaching limits of yield improvements. Read More »

Cathay Pacific’s full year 2018 results show the transformation on track but also too narrow. CEO Rupert Hogg has brought Cathay back to profitability with a small second half airline profit of HK$1.1 billion (USD$146m).

Cathay now enters 2019 in the third and final year of its restructuring. Yet it seems Cathay will need a subsequent restructuring that reaches deeper to change underlying culture. It may be especially needed if the passenger and cargo market outlook continues to soften.

The primary restructuring target is flat unit costs ex-fuel, which was broadly met in 2018 on a proforma basis (0.3% increase). Most costs are not under direct control. Essentially, fewer staff and geater seat density are needed to offset higher airport charges and labour rates, as well as the catering and IT improvements that should have been made long ago.

Costs are relative to yield, so a constraint on cost control shifts focus to yield growth. There have been genuine yield improvements but an opportunity has emerged to acquire HK Express, which would seemingly reduce competition and increase fares where it matters most: in the high-yielding local market.

The prospect of more expensive tickets to Japan, the main market of HK Express, is the crude but concise summary of public and local media concerns about Cathay’s possible HK Express acquisition, which hung over the airline’s annual results press conference, to the frustration of management that had brought the airline back to profitability. This is a time management needs to allay anti-competitive concerns and be seen as a friend of the market.

There were repeated questions about HK Express talks despite management saying it had nothing more to share. The 737 MAX grounding also pre-occupied discussions even though Cathay does not operate the MAX and nor does any other Hong Kong airline.

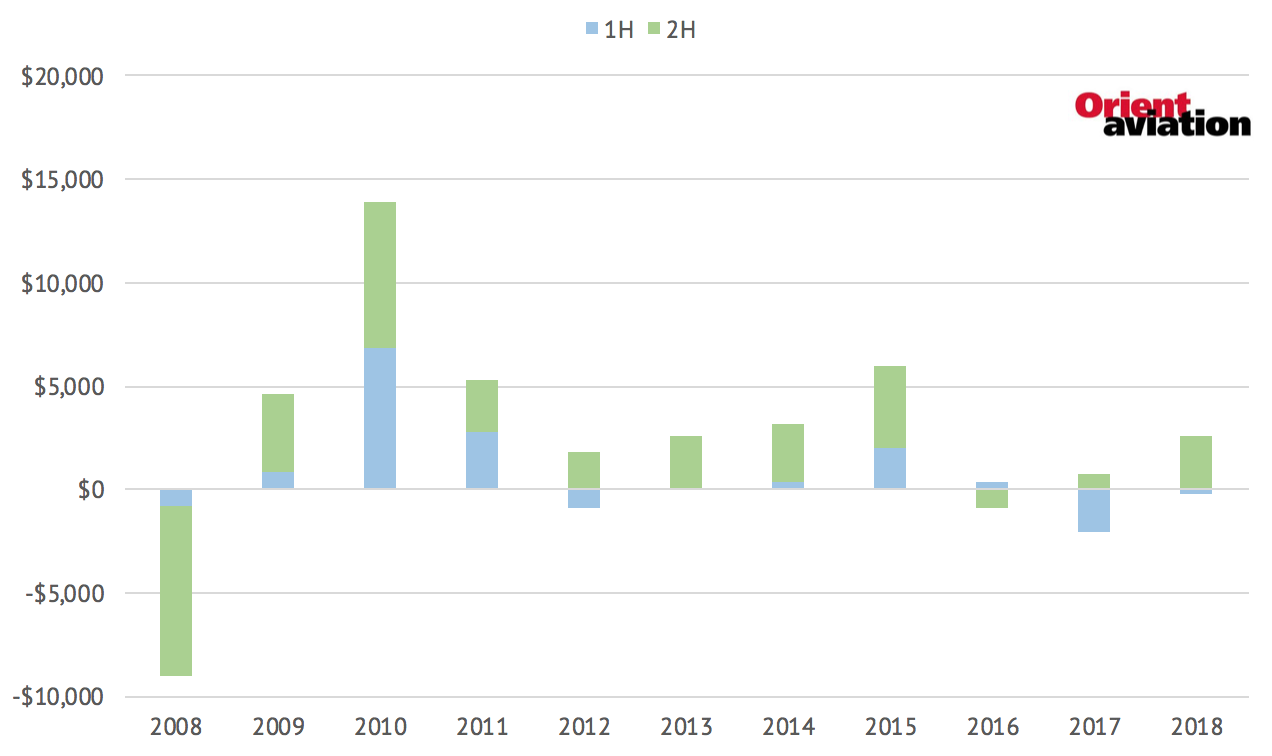

The 2018 profit was the result of a second half profit offsetting a first half loss. The second half saw revenue growing faster than costs – a welcome change. Historically, Cathay’s first half is weaker but not loss-making.

Cathay Pacific profit/loss attributable to shareholder by half (HK$ millions)

Source: Orient Aviation

The first half of 2019 should see a profit compared to 1H2018’s loss. The first half is boosted by a strong start to the year as the public sought alternatives to Hong Kong Airlines, which received negative publicity over its financial situation.

A second half improvement seems uncertain given weakening sentiment. Cathay’s restructuring was typical by front-loading cost reductions, excluding transformation expenses, before shifting to innovation.

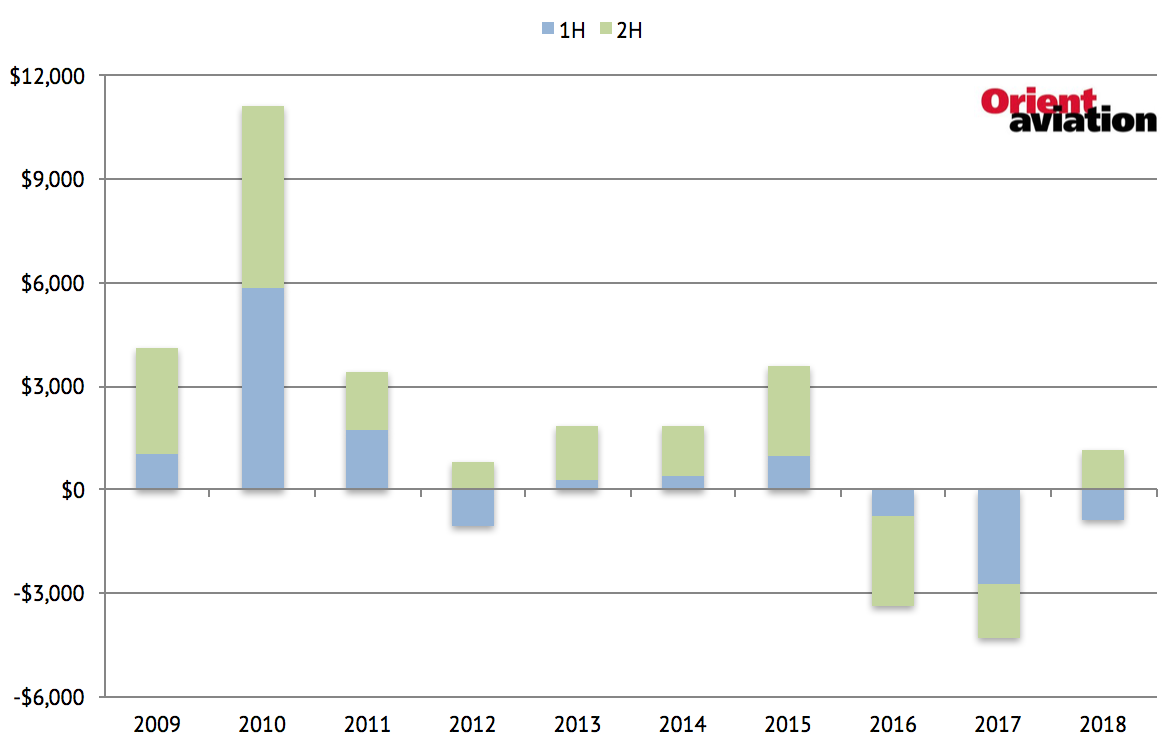

Cathay Pacific airline profit/loss after taxation by half (HK$ millions)

Source: Orient Aviation

Major cost reductions are completed but there is labour concern with cabin crew requesting a salary increase now that the airline has returned to profitability. Management still needs to reach a deal with pilots to end a long dispute. For the second time in four years, pilots voted down a deal reached between management and union leaders.

New revenue initiatives appear to still be in the early phase and unlikely to deliver substantial benefits in 2019. This will place pressure on Cathay to further improve revenue management, where the airline made early gains.

Yet there is a weakening cargo and passenger outlook, particularly for local Hong Kong traffic. December 2018 traffic statistics show a 0.3ppt decline in passenger load factor. The outlook is compounded by more market competition. Cathay expects to grow ASKs 6.8% in 2019, above its projected long-term average of 3-4% growth per annum. 2018 ASKs grew 3.5%.

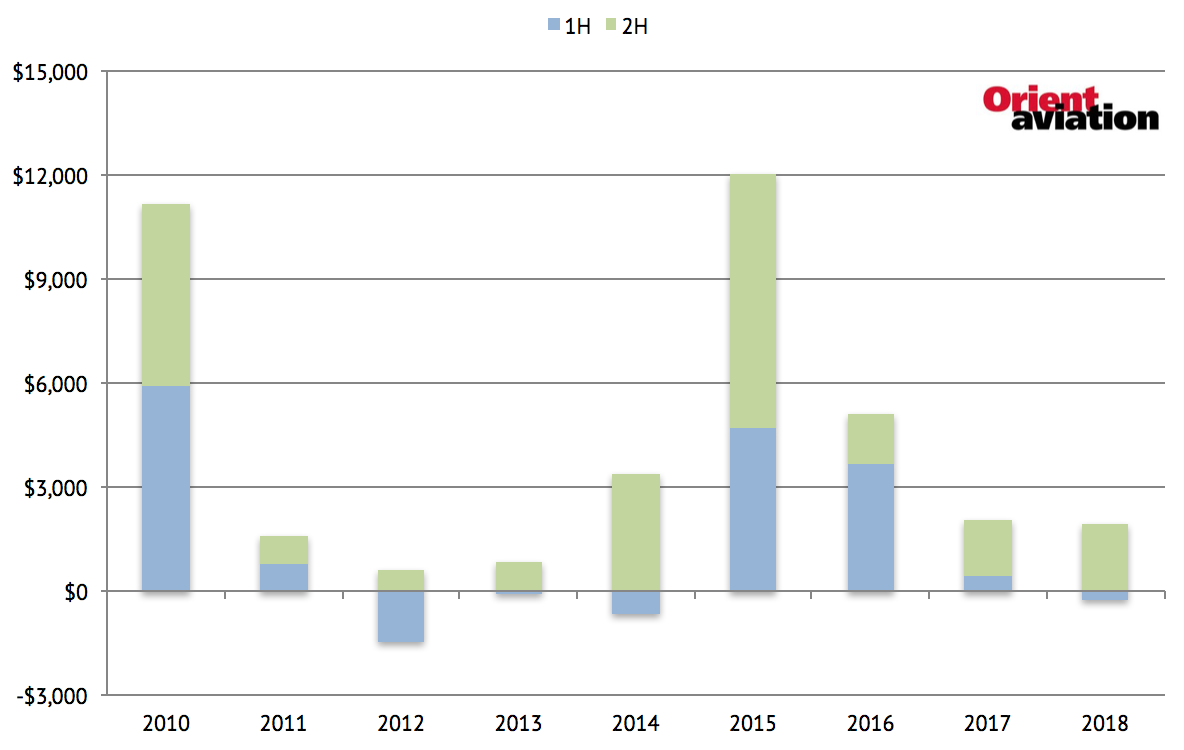

Cathay is coming off expensive fuel hedging losses, which amounted to US$184m in 2018, down from $812m in 2017. It is superficial to calculate a reversal of fuel hedging losses, but doing so gives a second half paper profit of $247m – still weak. Reversing historical fuel hedges gives the appearance of a better position, but still a foundation that could not meet cost of capital and needed transformation.

Cathay Pacific airline profit/loss after taxation by half, reversing fuel hedging loss/gain (HK$ millions)

Source: Orient Aviation

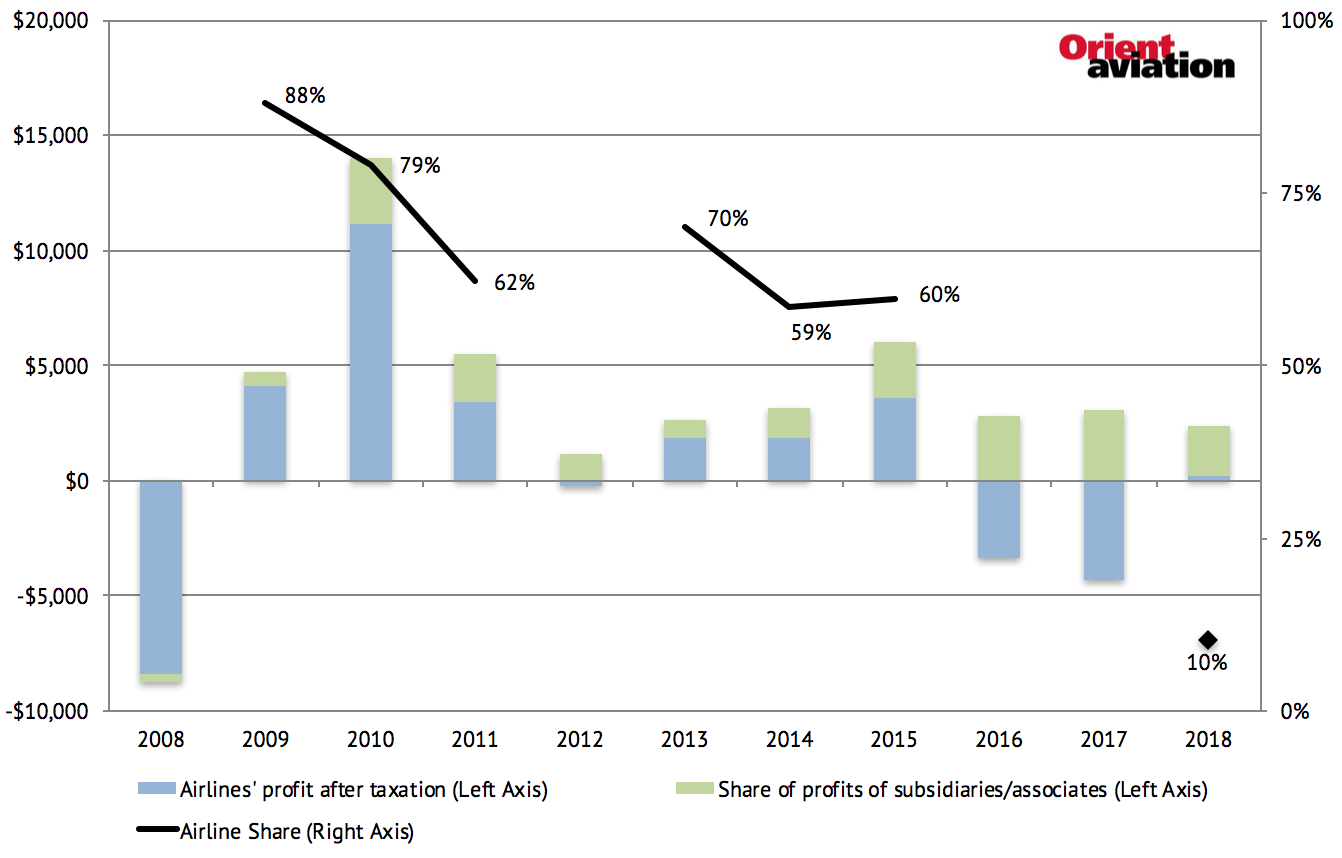

Over the long-term, Cathay’s airline profit has weakened while overall financial situation has been boosted by share of profits from subsidiaries and associates, notably Cathay’s investment in Air China and Air China Cargo. Subsidiary and associate profit declined from $388m in 2017 to $268m in 2018.

Cathay Pacific’s transformation differs from restructurings at other airlines by having a larger focus on yield growth than cost reduction. There is good reason for it: other airlines had bloated cost bases or saw intense competition, often from LCCs, render yield improvements unlikely. In contrast, Cathay was relatively efficient in the region but bad at selling itself and generating a yield premium.

Cathay Pacific profit composition (HK$ millions)

Source: Orient Aviation