News Backgrounder

Broke and grounded

Once the country’s leading carrier, Jet Airways’ long fall from grace has culminated in a desperate attempt to find an investor who will return it to the skies. Associate editor and chief correspondent, Tom Ballantyne, reports on the rise and threatened collapse of India’s first privately owned premium carrier.

May 1st 2019

Jet Airways may be down but it’s not quite out. Read More » That was the message from the carrier’s CEO, Vinay Dube, to Indian media last month when the airline was grounded after lenders refused to inject US$143.29 million into the carrier to keep it temporarily afloat.

With debts of $1.2 billion, no money for fuel, 20,000 direct and contract staff owed months in salaries and lessors taking back aircraft as payments lapse, the airline’s fleet ground to a halt on April 17. The final flight, for now, returned to its Mumbai base on April 18.

|

In a statement, the airline thanked its loyal customers for more than 25 years of loyalty and said it “sincerely and profusely apologizes for the disruption to the travel plans of all its guests. Since no emergency funding from lenders or any other source is forthcoming, the airline will not be able to pay for fuel or other critical services to keep the operations going”.

Since mid-April, various investors have submitted Expressions of Interest in the airline. Most recently, a group of the airline’s employees wrote to the carrier’s lead lender, the State Bank of India (SBI) and asked that a consortium of staff and “outside investors’ be allowed to take management control of the Mumbai-headquartered carrier.

The consortium leaders, the Society for Welfare of Indian Pilots and the Jet Aircraft Maintenance Engineers Welfare Association, said airline employees would contribute to the revival of the airline from their future earnings and increased productivity, Indian media reported.

It is generally viewed that a management buyout will not be able to compete with a shortlist that is reported to include, at one time or another, private equity firm, TPG Capital, aviation investor Indigo Partners and India’s National Investment and Infrastructure Fund. At press time, it was rumoured some of the cited firms had withdrawn from the process.

Etihad Airways, a 24% shareholder in Jet, is frequently mentioned as a potential Jet savior, but given its previous experiences with bankrupt airberlin and Alitalia and the fact it has reported losses of $2.8 billion in the last 24 months, investing in Jet would be an extremely high-risk venture.

Despite these views, senior Etihad senior adviser and former Jet CEO, Cramer Ball, has been seen on several occasions in Mumbai in the last month where he has been leading negotiations between the two airlines.

Jet CEO, Vinay Dube, an ex-Delta senior executive who is credited with keeping the airline going until its grounding said last month the management is “constantly” engaged with the government and lenders to seek a resolution to the debt crisis and that they will “not leave any stone unturned” in attempts to revive the airline.

“We are in constant touch with the lenders about getting a debt resolution done in a manner that makes sense for them and makes sense for us. I would like to think a flying Jet Airways makes definite sense for them [banks] because it preserves their value as well. We are not talking about anything that does not make good economic sense for the lenders. This is not charity for the sake of it,” he said.

| 'I suspect there are not that many brave souls out there who would come in, eyes wide open and be willing to assume the liabilities. In my view, it’s over' |

| Shukor Yusof Endau Analytics founder |

In another blow for Jet, Indian aviation regulators are planning to allocate the airline’s take-off and landing slots to other carriers on a “temporary” basis. India’s civil aviation secretary and former Air India chairman and managing director, Pradeep Singh Kharola, told a press conference in Delhi in late April that at least 280 slots were vacant in Mumbai and 160 in Delhi.

In response, Dube said the government had assured the airline this was a temporary move and the slots would be protected for Jet when it recommences flying. “While we have a combination of aircraft that are being deregistered or early terminated, the majority of them have not left the premises,” Dube said, and added they would be available to the airline when it re-started flying. Elsewhere, it is being reported other airlines, including state-owned Air India, have been talking to lenders about leasing some of Jet’s grounded fleet.

Senior management has been in talks with several companies in attempts to provide its staff with alternative jobs if a rescue does not eventuate.

They also have written to all employees to say the airline has no funds to pay employees medical insurance. Most of Jet’s work force has not been paid since January.

Apart from approaching airline rivals to ask them to take on Jet staff, the carrier’s chief people officer, Rahul Taneja, has met with Amazon and several non-aeronautical companies to offer them ex-Jet workers.

Full service joint venture carrier, Vistara, is reported to have hired 400 cabin crew and 100 Boeing pilots and is said to be negotiating the lease of 10 planes that are being deregistered by Jet.

Low-cost carrier Spicejet is signing contracts with up to 1,000 ex Jet staff and Air India has said it intends to hire 250 cockpit and cabin crew from its rival airline.

It was reported three senior Jet executives - general counsel Ashok Barimar, vice president planning Abhijit Dasgupta and senior vice president engineering and maintenance Adam Voss – have resigned and that the cargo and products bosses are on leave.

|

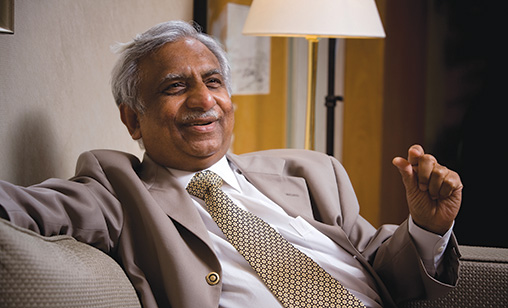

Perhaps the saddest figure of all in Jet’s demise is founder Naresh Goyal, who was forced to resign as chairman of the airline in March after he fought a long battle to retain control. “For the past 25 years, Jet Airways has been a way of life for me,” he told customers in an email message after stepping down. “I would be lying if I said this was not an emotional moment for me.”

Born in Punjab’s Sangrur in northwest India, Goyal began his working life in 1967 as a cashier earning $33.40 a month in the travel agency owned by his maternal uncle, Seth Charan Das Ram Lal. After graduating with a commerce degree, Goyal won the General Sales Agent (GSA) contract for Lebanese International Airlines and in 1969, aged 20, he was appointed public relations manager of Iraqi Airways.

He moved to ALIA Royal Jordanian Airlines as regional manager in 1971 and then to Middle Eastern Airlines’ Indian branch, where he learnt the intricacies of 1970s style airline ticketing, reservations and sales.

In 1974, with £500 from his mother, he set up his own GSA, Jetair, that represented top tier airlines including Air France, Austrian Airlines and Cathay Pacific, in India. A year later, he added regional manager of Philippine Airlines to his CV. Before starting Jet, he was GSA for 17 foreign airlines in India, a business that was much more influential than travel agencies at the time.

In 1993, Goyal seized the opportunities offered by the opening of the Indian economy and the launch of an Open Skies Policy by the Indian Government to set up Jet Airways, initially as an air taxi operator. A year later, using his Middle East connections he sold a 20% share in fledgling Jet to both Gulf Air and Kuwait Airways. Both carriers later sold out.

Jet launched international services in 2004 and listed successfully on the Mumbai Stock Exchange a year later. The carrier’s share price has never recovered from its IPO peak. After Jet went public, Forbes magazine listed Goyal as the sixteenth richest person in India, with a net worth of $1.9 billion. At its peak, with 22% of the market, Jet operated more than 120 aircraft that flew 600 daily domestic and international flights.

What went wrong? Some analysts point the finger at Goyal’s extremely hands-on approach to his airline. They said it created tensions with a number of expatriate CEOs, including Australians, Cramer Ball and Gary Toomey, and Greek-American Nikos Kardassis, all of whom attempted to turn around the airline. In the space of a decade, the airline also had three acting CEOs, Ravishankar Gopalkrishnan, Gaurang Shetty and Amit Agarwal.

Another major contributing factor to Jet’s decline was the 2006-2007 purchase of Air Sahara for $500 million in cash, a decision Goyal took against the advice of associates. They said he was paying too much.

At the same time, India’s LCC industry was gaining momentum with budget carriers IndiGo and SpiceJet pouring capacity into the market and forcing a fare war Jet could not afford. High oil prices, hefty fuel taxes and a weak rupee added to the pressure on Jet’s bottom line. The fates, it appeared, were not being kind to Jet.

As the Global Financial Crisis (GFC) unfolded, Jet was in the process of a major expansion phase using wide bodies. The GFC shredded the market for premium air fares and oil prices began to rise. The airline had to lease its aircraft to other carriers to survive the fuel shock. Then, as it began to recover and retrieve its planes, oil rose again to its highest level in years, sparking another fuel shock.

After protracted negotiations, Etihad Airways paid US$379 million for 24% of Jet when James Hogan was running the Abu Dhabi airline. An Etihad team arrived in Mumbai to fix Jet and introduced a more structured management plan to take the carrier into profit. Within 18 months they exited the revolving C-Suite door unable to persuade Goyal to re-structure the airline.

The result: Jet posted losses in nine of the last 11 years and struggled to pay down its debt, which had risen to $1.6 billion at the end of March last year. If the carrier finds a White Knight and returns to the sky, the future Jet Airways has to be a very different airline to survive.