News

AirAsia Group in talks to raise US$235 million in fresh capital

July 10th 2020

AirAsia Group CEO, Tony Fernandes, said this week the company was working on raising as much as 1 billion ringgit (US$235 million) in Malaysia and had applied for loans in Indonesia and the Philippines as he sought to reassure investors about the low-cost carrier's (LCC) financial position. Read More »

The airline group's shares lost about a sixth of their value on Wednesday, following the release of its audited financial accounts for the 12 months to December 31, 2019.

In the report, auditors Ernst & Young noted the company's net loss of 283 million ringgit in calendar 2019 and that current liabilities exceeded current assets by 1.843 billion ringgit.

It said the global coronavirus pandemic had led to a significant fall in demand for air travel and impacted the airline group's financial performance and cash flows.

These events and conditions indicated the "existence of material uncertainties that may cast significant doubt on the group's and the company’s ability to continue as a going concern", Ernst & Young said.

Nevertheless, the auditors said there had been positive developments amid the recent lifting of travel restrictions in its markets, with booking trends, flight frequencies and load factors gradually improving to cater for increasing demand.

"The financial statements of the group and the company have been prepared on a going concern basis, the validity of which is dependent on a successful recovery from the COVID-19 pandemic in conjunction with actions taken by the governments of the respective countries and a favourable outcome of the ongoing discussions with the financial institutions and investors to obtain required funding and successful implementation of the management's plans for future actions," the auditors said in the full year accounts.

The unqualified audit opinion led to AirAsia Group shares tumbling 17.5% on the Bursa Malaysia on Wednesday.

On Thursday, Fernandes acknowledged the first half of calendar 2020 had been "extremely challenging" as its operating carriers went into “hibernation” amid restrictions imposed by governments around the world.

However, airlines have gradually been returning to the skies, particularly in domestic markets, while discussions about the introduction of “travel bubbles" or "green lanes" on some international routes were encouraging.

Nonetheless, the company was not expected to return to levels prior to the coronavirus pandemic for a number of years.

Fernandes said he understood the importance of shoring up AirAsia Group's liquidity to ensure sufficient cash flow.

"We have been presented with proposals in various forms of capital raising, be it debt or equity, and are in ongoing discussions with numerous parties, including investment banks, lenders and interested investors in seeking a favourable outcome for the group," Fernandes said in a statement yesterday.

"We have received indications from certain financial institutions to support our request for funding, amounting to more than 1 billion ringgit."

Fernandes said a certain portion of the loan would be eligible for a Malaysian government guarantee scheme.

AirAsia's Philippines and Indonesia affiliates were "currently in various stages of bank loan applications".

"In the Philippines, we have applied for the government guaranteed loan under the Philippine Economic Stimulus Act (PESA), with an expected positive outcome,” Fernandes said.

The audited financial accounts for calendar 2019 were published in the same week AirAsia reported a net loss of 953 million ringgit for the three months to March 31, 2020. It was a billion ringgit deterioration from a net profit of 102 million ringgit 12 months earlier.

Revenue dropped 15%, to 2.3 billion ringgit, the company said in a regulatory filing to the Bursa Malaysia.

The AirAsia affiliates in India, Indonesia, Japan, the Philippines and Thailand carried a combined 17 million passengers in the first quarter of 2020, down 17% from 20.4 million 12 months earlier.

Its Malaysia, Indonesia, Philippines and Thailand joint ventures carried fewer passengers, while India and Japan experienced an increase in traveller numbers.

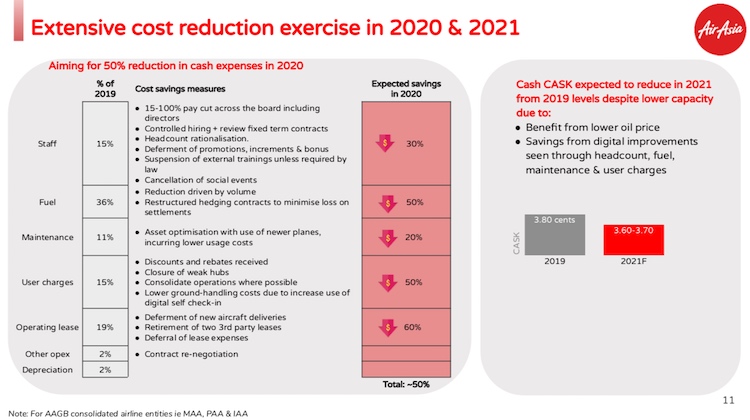

AirAsia said it was aiming to cut cash expenses by 50% in 2020 through job cuts, reduced salaries, restructured fuel hedging contracts, deferring new aircraft deliveries and dropping loss-making routes, among other initiatives.

Capacity, measured by available seat kilometres (ASK), was forecast to be 45%-60% of 2019 levels this year and at 85% in 2021.

Load factors were predicted drop to 70%-75% this year, before returning to 2019 levels at 85% in 2021.

"We expect a U-shaped rebound of tourist arrivals within the Asia-Pacific, with domestic recovering at a faster pace than international," the company said in a slide presentation accompanying the quarterly results.

"We expect the market to normalise in late 2021."

Fernandes said the company had weathered many crises in its history and would emerge stronger from the current situation, with management "working tirelessly" to ensure the sustainability of its business operations.

"The impact of the COVID-19 pandemic on the company is never taken lightly, as does the trust and support put in us," Fernandes said.

"With the confidence of our stakeholders and business partners, we are determined to move forward in this new normal.

"We are positive the proactive mitigating actions we have implemented as well as our consistency in transforming the company will aid us in recovering and overcoming this operating environment."

Written by Jordan Chong

|