Airports

Asia's airport boom

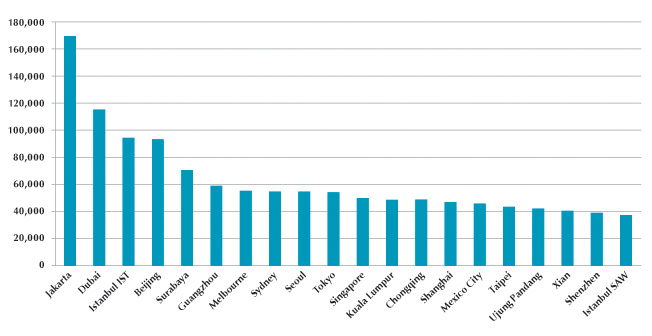

Last month, 16 of the 20 fastest growing airports in the world were in the Asia-Pacific. Little wonder many of the region’s major hubs have announced big expansion plans as demand, and congestion, escalates.

September 1st 2012

Southeast Asia’s busiest airport, Jakarta’s Soekarno-Hatta International Airport in Indonesia, has announced plans to triple its capacity by 2014 at a cost of $2.8 billion. Read More »

Built to handle 22 million people annually, last year its throughput grew 19.2% to reach 52 million. The expansion will raise its capacity to 62 million.

|

| Singapore Changi International Airport: plans to almost double its size to cope with major traffic growth |

Jakarta is not alone when it comes to expansion as the region’s major hubs prepare for unprecedented growth in the next two decades. They are also aware of the ongoing threat from major hubs in the Middle East which continue to report record growth, some of it drawn from congested Asian facilities.

Among other developments:

• Singapore has announced that 1,000 hectares of land has been earmarked for the expansion of Changi International Airport, a move that will almost double the airport’s size.

• Work on a $2 billion expansion of Bangkok’s Suvarnabhumi airport began in July and last month plans for a third runway, at a cost of $410,000, were given the green light.

• Other projects include Hong Kong where a third runway has been approved at Chek Lap Kok. Korea’s Incheon Airport, which has three runways, is considering the construction of two more.

• In India, Prime Minister, Manmohan Singh, has directed the civil aviation ministry to augment airport capacity across the country without delay and make plans to begin building 16 greenfield airports and upgrade another 17 using public and private partnerships.

• And China’s well publicized airport expansion plans are showing no signs of easing despite some slowdown in local economic conditions. At the International Air Transport Association annual summit in Beijing, in June, Civil Aviation Administration of China (CAAC) chief, Li Jiaxiang, reiterated China would build 70 new airports in the next few years and expand 100 existing facilities. China will have more than 230 airports by the end of 2015.

Jakarta’s plans, in addition to expanding its three passenger terminals, include additional runways and a larger cargo terminal. The president director of the state-owned airport management company, PT Angkasa Pura II, Tri S. Sunoko, said the project “is a major part of the government`s efforts to overcome transportation problems relating to capacity, accessibility and connectivity, as well as environmental aspects”.

| The world’s fastest growing airports Ranked by total seats added this August versus last (source: Diio Mi) |

|

According to Airports Council International (ACI), Soekarno-Hatta is now the world’s 12th busiest airport. It overtook Bangkok’s Suvarnabhumi and Singapore’s Changi as Southeast Asia’s busiest airport in 2010.

Singapore set land aside for Changi’s expansion after a special task force recently visited several airports, including Hong Kong, South Korea’s Incheon and the Middle East.

A final report on Changi’s development needs, including the timing of construction of a third runway, is to be completed by the end of this year.

At Bangkok, a decision on a third runway is considered to be long overdue. The airport has been operating beyond its 45 million passengers a year capacity for two years and has been dogged by problems.

In June, the eastern runway was closed for repairs and the airport’s radar system broke down, crippling flights and causing diversions. In July, there were multiple disruptions when a section of the western runway subsided.

There are fears a third runway, 4,000 metres in length, may still not meet the airport’s needs. Analysts said expansion plans, designed to raise capacity by 33% in the next six years to 60 million passengers, still lag behind projected traffic volumes.

Meanwhile, the Airports Authority of Thailand (AoT) is facing problems at Bangkok’s second airport, Don Mueang. Originally the major international airport, Don Mueang re-opened as a low-cost facility.

Last month, South Korean budget operator, T’way Airlines, halted its operations through the airport, accusing the authorities of failing to provide sufficient service and facilities to support international flights.

It lodged a formal complaint to the Civil Aviation, Immigration and Customs departments which said there were too few check-in counters, no value-added tax (VAT) refund facilities, breakdowns of luggage carousels, lax security and a shortage of immigration officers. T’way has switched its flight operations to Suvarnabhumi and said it has no intention of returning to Don Mueang.

While Thai-owned budget airlines, Nok Air and Orient Thai, operate domestic flights from Don Mueang only one low-cost airline group, AirAsia, has committed to relocating entirely to Don Mueang from October.

In India, plans for desperately needed airport infrastructure are facing major hurdles because developers are experiencing difficulty in acquiring land. The problem has stalled the Navi Mumbai, Goa and Nagpur airport projects and is threatening other development plans.

State governments have turned down or ignored most of the 61 requests for land allotments made by the Airports Authority of India for projects across the country. Experts warn the cost of land is making many projects unviable.

A research report from consultant, CAPA, said amendments to the country’s Land Acquisition Bill being considered by Cabinet will lead to price increases because it seeks to protect the rights of landowners whose property is acquired for major projects.

The CAPA report said domestic airports need investment of at least $40 billion in the next 13 years to keep pace with growth in air passenger traffic from 143 million in 2010-11 to 452 million by 2020-21.

“But for these investments to be feasible, land must be allocated right away. In Navi Mumbai’s case, acquisition costs are expected to cross a billion dollars, a figure that has seriously dented investors’ enthusiasm,” said the report.

“The lack of progress over several years in awarding Mumbai’s second airport and other greenfield non-metro airports have driven away big-ticket investors such as Fraport and Changi from India.”

Strong Asia-Pacific rebound

Figures released last month by Airports Council International (ACI) show a strong rebound by Asia-Pacific airports in the first six months of 2012, with an 8.5% increase in passenger traffic compared to the same period last year.

ACI Asia-Pacific regional director, Patti Chau, said the region experienced a challenging year in 2011. “Driven by the growth in intra-regional and domestic passenger traffic, the region remains resilient to the economic uncertainty that is still looming in other parts of the world,” she said.

“Many airports in the region are undergoing expansion projects or construction of new airports and this positive half-year result proves that they are going in the right direction and gives confidence to government and private investors.”

While the Middle East is outperforming other regions with growth of 13.2% year-on-year in passenger traffic, the Asia-Pacific is not far behind. Beijing Capital International Airport handled more than 39.3 million passengers in the period and is the second busiest airport in the world after Atlanta in the U.S.

Major international hubs in the region recorded big gains. Bangkok saw an increase of 14.2% and Singapore and Seoul Incheon handled 11.6% more passengers in the first six months of 2012 compared to 2011.

ACI also reported encouraging news from Japan. Osaka Kansai and Tokyo Narita both recorded traffic increases of more than 21% year-on-year.