Special Reports: MRO

Manufacturers win more airline business from MROs

The Asia-Pacific is the centre of the future global airline maintenance, repair and overhaul (MRO) business, but the path to profit is no longer a straight line for global MROs. Manufacturers are winning an ever larger slice of the Asia-Pacific MRO pie.

May 1st 2014

Global spending on MRO for jets and turboprops will increase by more than 4% this year, to $57.7 billion, and reach $86.8 billion by 2024, industry forecaster TeamSAI reported in its latest Global MRO & Fleet Forecast. Read More »

However, the market is no longer as neatly compartmentalized as it once was for global MROs.

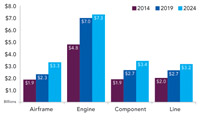

2014-2024 Asia-Pacific regional MRO forecast by market segment (USD)

Source: TeamSAI Consulting Services

• Airframe MRO spend, expected to be $1.9 billion in 2014, is forecast to grow by 4.4% annually in the first five-year period to $2.3 billion in 2019 and by 7.4% in the second five-year period to $3.3 billion in 2024. • Engine MRO spend, pegged at $4.8 billion in 2014, is forecast to grow 7.8% annually to $7.0 billion by 2019 and then by 0.8% annually in the second five-year period to $7.3 billion in 2024. • Component MRO spend is forecast to be $1.9 billion in 2014, growing by 7.0% annually in the first five-year period to $2.7 billion. The second five-year period is forecasted to have 5.2% annual growth to $3.4 billion by 2024. • Line maintenance, anticipated to be $2.0 billion in 2014, will grow by 5.8% annually in the first five-year period to $2.7 billion in 2019 and by 3.6% in the second five-year period to $3.2 billion in 2024. * Figures exclude China |

Airline manufacturers and engine makers are winning an ever bigger share of the MRO pie, especially in the Asia-Pacific, as they increase their involvement in after-market services and support.

TeamSAL said in its April report that “Asia-Pacific countries should grow at a healthy 5% per annum and [soon] match the business turnover of Western Europe and North America [in MRO].”

“China is forecast to have an MRO market that 2.5 times larger than its 2014 level within a decade , with annual growth estimated at 9.8%. India is calculated to expand at well over 10% per year in the forecast period, even though it will hold a relatively small share of the regional market, at 1%-3%,” said TeamSAL.

In a separate report published last month by the aviation intelligence consultancy, the Leeham Company, the lines of competition between third party MROs and OEMs identified a trend that has been intensifying in the industry for several years.

OEMs are developing the services sector of their businesses as profit centres. Leeham said Boeing’s decision to relocate its Commercial Aviation Services (CAS) unit from Seattle to its under-utilized Long Beach, California complex, reinforced the trend.

After-market support services at Long Beach will be for all out-of-production 7 series aircraft, airliners which need the most maintenance. Support for new model jets, such as the B787 and the 737 MAX and 777X will remain at Seattle.

While Boeing does not break out details of the contribution after-market support makes to Boeing’s bottom line, in 2010, the then chief executive of the commercial airplane arm, Jim Albaugh, told employees CAS contributed $1 billion in profits to the company.

The trend by OEMs to increase services has been underway for years,” said Leeham. “Engine manufacturers have historically tied engine sales to after-market services and support. This trend has increased dramatically in recent decades. GE Engines, CFM and Rolls-Royce have been particularly aggressive in writing after care contracts.

“More recently, Pratt & Whitney and its joint venture partner, International Aero Engines, announced programs intended to dramatically increase the PW/IAE services profile.”

On the day Boeing unveiled the CAS move, IAE announced three V2500 services contracts and qualifications. Pratt & Whitney is planning an engine service program for its Pure Power Geared Turbo Fan engine that will enter service next year on the new Bombardier CSeries and the A320neo, said Leeham.

About 60% of A320 family operators using V2500 engines contract with IAE for services. About 80% of new customers will do so. IAE argues that residual values for A320s powered with its engine will be enhanced by using OEM parts and maintenance compared with a third party MRO or an airline’s in-house maintenance shop.

Analysts say the increasing involvement of OEMs may be an irritant to the third party MROs, but they are reacting, with many of them becoming involved in joint ventures to ensure they retain at least part of the business.

And with the steady growth in Asia-Pacific aircraft fleets over the next few years, they still believe there is plenty of work to go around. The commercial fleet in Asia-Pacific (excluding China) is forecast to grow by 5.4% annually in the next five-years, to 4,752 aircraft by 2019, and by 3.5% in the second five-year period, to 5,638 aircraft by 2024. It will receive 17% of global deliveries, or 2,808 aircraft, over the next decade.

China alone will account for 14% of the forecast deliveries in the next ten years (2,315 aircraft) and an overwhelming majority of these are for fleet expansion, rather than replacement.

“Like the Asia-Pacific”, said Team SAI, “China is a key growth market and a major driver of global fleet growth. The current baseline fleet (2,001 aircraft) is forecast to grow by 8.1% annually in the first five-year period to 2,949 aircraft by 2019 and by 6.5% in the second five-year period to 4,043 aircraft in 2024. Over the ten-year period, the Chinese fleet is forecast to grow by 7.3% annually and nearly double in size. China’s share of the global fleet is expected to increase from nearly 9% in 2014 to over 12% in 2024.”

TeamSAI says the global economy is expected to improve in the coming years, although concerns remain over the pace and complexion of the recovery. “While no two airlines are the same, generally speaking, across the world and especially in North America, airlines operate with very thin margins. Thus, major cost drivers, such as labor, maintenance and fuel, greatly influence their performance. Operators are relentless in their pursuit of managing these costs. With limited leverage over labor and fuel costs though, airlines are right to focus attention on the cost of maintenance.”

Though the focus of MRO is naturally on the mainstream areas such engines, mainframe and components, industry insiders also point to some additional avenues of growth with the potential to add significantly to the MRO business menu over coming years. For example, working with the Aircraft Fleet Recycling Association (AFRA), TeamSAI recently completed a detailed survey of this rapidly growing MRO segment. “Due to higher retirement and teardown rates, we estimate that nearly $3.2 billion in harvested parts will be introduced into the MRO supply chain in 2014. And with rates expected to increase over the coming years, the potential impact to OEM and MROs is significant. In addition, changes in fleet mix and the growing involvement of OEM’s in the aftermarket all make for serious business planning considerations to any MRO and airline maintenance and engineering organization.”

Some experts are also forecasting that aircraft modernization-related MRO will grow by around 10% this year. According to Lithuanian-based LF technics, which also operates in Russia, the United Kingdom, Poland, Italy and Malaysia, that belief is largely based on an increasing necessity to grow competitiveness through fleet unification (especially among the merged airlines), the development of on-board entertainment services and the growing need for on-board Wi-Fi systems. “Moreover, carriers worldwide are still struggling to cut down on operating expenses. This forces them to consider such options as weight reduction, which can be achieved through cabin modifications and the implementation of lighter materials.

| SR Technics sets down in Asia Swiss-based SR Technics, owned by Abu Dhabi’s Mubadala Development Company, has opened a component repair shop in Kuala Lumpur, its first facility in Asia and the intended hub for the MRO’s expansion into the region. Part of the Mubadala Aerospace MRO Network, SR Technics has more than 1,000 aircraft on contract worldwide, said the company’s senior vice president of component services, Felix Ammann, at the component centre’s opening. The airlines include Garuda Indonesia, Singapore Airlines, Philippine Airlines and Qantas Airways, as well as a small contract for narrowbodies with a Malaysian company, the Zurich-based MRO said. Last December, AeroAsia (GMF) in Indonesia and SR Technics established a component support workshop in Jakarta for Garuda’s A330s and B737NG aircraft. It is working with GMF to develop the Indonesian MRO’s existing in-house repair capabilities, which reduces turnaround times for in-country MRO support. “At SR Technics, we have seen the number of aircraft operating with an integrated component services agreement increase by more than 20% year-on-year over the past four years,” said Amman. SR Technics Malaysia general manager, Heinz Freimann said: “Whenever a customer airline needs components repaired in the region we can be the service centre for them. On the other hand, we are also transferring business from Switzerland to Malaysia, based on existing long term contracts.” Freimann said SR Technics will offer airlines solutions or new products and services that are not available in the Asia-Pacific. “By mid-2015, we will have the capability to carry out 1,200 component repairs, up from the 300 now. Each of these offerings will come with its own processes, materials, tools and test equipment, infrastructure and specialist technical know-how and skill needs,” he said. The 150,000 square feet Kuala Lumpur facility, with capabilities for hydraulics, pneumatics, mechanical and electrical and electronic products, has 110 staff, including 77 technicians, of which 94% are Malaysians, with plans to add 20 staff to the complex by year end. The facility operates under the European Aviation Safety Agency, the Federal Aviation Administration and the Department of Civil Aviation approvals. |