News Backgrounder

Hong Kong transforms to “AirportCity” to intensify focus on China’s Greater Bay Area

August 1st 2023

It is the most ambitious project Hong Kong-headquartered New World Development has undertaken, but it is not being built for the 7.5 million residents of the Special Administrative Region alone. Read More »

The developer and the backers of the 3.8 million sq. ft SKYCITY 11 Skies retail, dining, entertainment and commercial mini-city adjacent to Hong Kong International Airport have their sights set on a market multiple times in size to their home hub – the 86.6 million citizens of China’s nine Greater Bay cities that are only 90 minutes away via the Zhuhai-Macau-Hong Kong bridge.

|

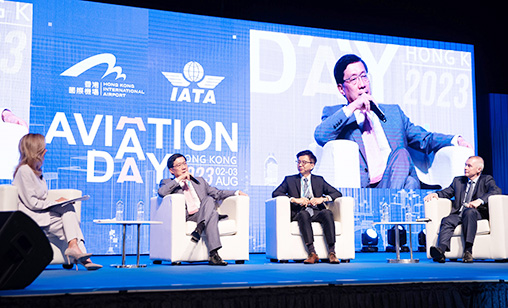

In early August, at an “Aviation Day” jointly organized by Airport Authority Hong Kong (AAHK) and the International Air Transport Association (IATA), the scale of the investment intended to capture the huge potential of the GBA’s passenger and cargo business to and through Hong Kong International Airport was spelt out to hundreds of invitation-only delegates attending the Aviation Day in Hong Kong.

SKYCITY’s all-encompassing retail, dining, entertainment and commercial immersive lifestyle development, soon to open its first phase, is being built to attract Mainland travellers and visitors to an immersive seamless experience of entertainment and travel at AirportCity offering patrons and air passengers airlines, hotels, entertainment, shopping, dining and cross-border commercial business enterprises under one gigantic roof that is steps away from HKIA’s two terminals.

The Greater Bay Area (GBA) is made up of nine provinces – Dongguan, Foshan, Guangzhou, Huizhou, Jiangmen, Shenzhen, Zhongshan and Zhuhai – and the Hong Kong Special Administrative Region.

Its residents comprise 10% of the population of the People’s Republic of China and they are only bridges away from the Hong Kong International Airport and its intermodal transport network to the world.

GBA’s citizens also are the most affluent in China and benefit from a young population pumped by ambition and an appetite for innovation.

At the Aviation Day, McKinsey and Company partner, Steve Saxon, who is based in Shenzhen, said there is huge pent up demand on the Mainland for travel to Hong Kong and these tourists spend an average of US$4,700 a trip. About 85% of these well-heeled travellers want to shop and sightsee in Hong Kong because they believe Hong Kong offers them the biggest product range and better quality goods.

It is precisely this market, as well as increased air cargo traffic, that AAHK seeks to attract both for airlines operating out of Hong Kong and 11 Skies. To that end, to support throughput at HKIA, it is building 30 in – town passenger check in centres in the GBA, providing seamless passenger check in for Mainland citizens travelling to HKIA for their departing flights. Passengers checking in at a Mainland centre will be able to go straight to the gate after arriving at HKIA from China.

Additionally, HKIA will soon open two automated car parks, each with 3,000 car spaces, exclusively for Mainland visitors. The first facility, for park and fly customers, is scheduled to open later this year and the second, for park and visit customers, in 2024. Travellers from the GBA will be able to drive, via the Hong Kong-Macau-Zhuhai bridge, to HKIA, park their cars at HKIA for visits to or departures from HKIA.

Said Cathay Pacific GBA general manager, Wilson Lam: “the travel market has grown significantly in the last few years. We are seeing the big impact of LCCs in the GBA and they will bring more destinations to it. Its development is big enough for all players.”

Greater Bay Airlines chief operating officer, Liza Ng, said the goal is for all travellers in the region to choose to fly from GBA airports without friction.

| 'Massive demand for travel from China but it is held back by Mainland visa rule restrictions' |

| Steve Saxon McKinsey and Company partner |

McKinsey’s Saxon told Aviation Day delegates Mainland air travel already was 120% of pre-pandemic levels, albeit driven by domestic demand. Outbound international travel from China was about 40% of 2019.

However, a panel moderator, UBS’s MD head of research, Eric Lin, said Asia-Pacific tourist arrivals “continue to improve and will experience very, very rapid” going forward.

“GBA is now an extended home market [for HKIA} so it is a mind shift.” he said.

Cathay Pacific group CEO, Ronald Lam, said supply and demand balance has not yet been achieved. “Sometime next year, we will be back to pre-pandemic capacity,” Lam said. Mirroring a trend in LCC growth observed by some speakers, Cathay’s 100% subsidiary, HK Express, was operating at 100% capacity at press time.

At the moment, about 85% of passengers prefer to book one week away from travel and are not returning to advance booking in the same volume as pre-COVID, delegates learnt, but that does not mean they are not planning a trip long-term, speakers said.

But the HKIA still faced challenges to its visionary expansion, Cathay Pacific chief commercial officer, Lavina Lau, said speaking in her capacity as chair of the HKSAR Board of Airline Representatives (BAR). The top issues for the Hong Kong BAR’s 72 members are labour shortages and the high cost of operating in Hong Kong. Lau urged the government and the AAHK to help the industry address these obstacles to a full return to air passenger capacity.

AAHK chief commercial officer, Vivian Cheung, in her keynote address at the Aviation Day said AAHK and HKIA had used the pandemic period to install systems facilitating facial recognition for air passengers, install the Sky Bridge between Terminal 1 and the midfield terminal, incorporate totally autonomous visual airfield technology, begun third runway operations. It also will introduce autonomous driver-less vehicles for airside ground handling operations. The Sky Bridge has become a tourist attraction and the authority and the airport is studying the feasibility of “smarter no passport” flights.

In her address, Cheung defined the scale of the market AAHK and HKIA aim to win. The Greater Bay Area has an annual GDP of US$1.7 trillion, she said. Between the 86.6 million residents of the GBA, more than 200 million air passenger trips are being made a year, she said. Overall, GBA load factor was 82% with long-haul load factor at 89%.

megan moroney says:

January 27th 2024 12:26pm