News

India raises goods and service tax for premium air travel

September 5th 2025

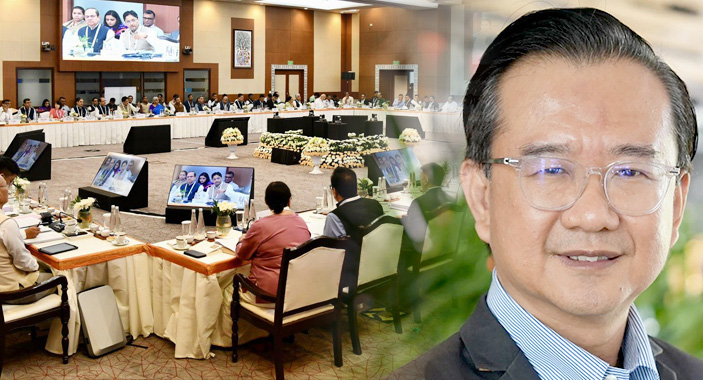

India’s Goods and Services Tax (GST) Council will increase GST for Premium Economy, Business and First Class airline tickets to 18% per ticket from 12% at present. Read More » The higher tax will come into force on September 22. GST for economy class travel will remain at 5%. The new rate will be levied on all domestic flights, international flights originating in India and redemption tickets. An International Air Transport Association (IATA) statement has expressed disappointment with the decision. “In many ways, India has been an amazing aviation story with its impressive growth, record aircraft orders and world class infrastructure. Aviation has tremendous potential to contribute to India’s economic growth, both directly as India’s airlines grow and indirectly through increased connectivity for travellers and businesses alike. It is therefore disappointing to hear of a decision to increase the GST on non-economy travel with no clear justification. This increase runs counter to the efforts of the country’s carriers, which have been investing in their premium products to enhance the travel experience on their flights. Tax on non-economy air travel has risen dramatically – at GST of 18% after yesterday’s announcement compared with 8.6% in 2017. For its aviation industry to thrive, India needs to take a whole of government approach in considering broader policy and the risks of such policies on dampening demand and undermining profitability. Asia-Pacific airlines are forecast to earn US$2.60 per passenger in 2025. Taxing premium travelers, who often make a difference to a route’s viability, is counter-productive,” IATA regional vice president Asia-Pacific, Sheldon Hee, said.