Addendum

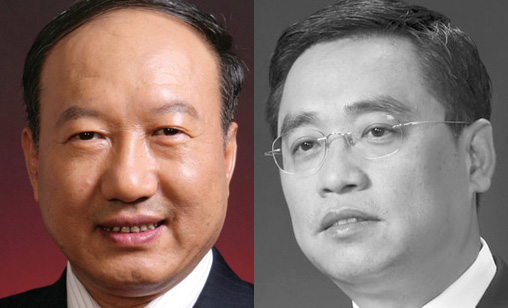

HNA’s Chen Feng voted sole chairman after sudden death of co-founder Wang Jian

July 1st 2018

HNA Group has announced co-founder, Chen Feng, has taken full control of the Mainland aviation to services group after the accidental death of Wang Jian early this month. Read More » Fifty-seven-year-old Wang served as co-founder and co-chairman of the Chinese conglomerate and was a key Chen ally. Adam Tan will continue in his role as HNA Group CEO as the group progresses through a tricky restructuring of its estimated long-term debt of scores of US$ billions generated by a two-year global acquisition spree.

HNA Group said Chen was appointed chairman by its board on July 5 – two days after Wang died from a fall while holidaying in southern France. HNA provided no details of the fate of Wang’s 15% holding in the conglomerate. The Financial Times reported Chen has a 15% equity in the group and that CEO Tan holds three per cent.

|

“Together, we mourn the loss of an exceptionally gifted leader and role model, whose vision and values will continue to be a beacon for all who had the good fortune to know him, as well as for many others whose lives he touched through his work and philanthropy,” a HNA Group tribute said.

At press time, The South China Morning Post said HNA Group revealed in filings in July 2017 that Wang “pledged to donate all his shares … upon resignation or death” to the two charitable organisations that control the HNA Group.

Chen and Wang established the foundations of the HNA Group in China’s Hainan Island province in 1993. Funding from Mainland sources was hard to come by so Chen embarked on a global funding road show where he famously persuaded U.S.-based billionaire, George Soros, to invest in the carrier. The deal made headlines around the world. No U.S. partner had invested in the government controlled Chinese aviation sector. Over time, Soros’s foundation has reportedly divested its holdings in the group.

Since then, Chen has risen to the top of China’s corporate tree and now travels the world to secure deals in one of two B787 jets. Deceased Wang, according to several sources who spoke to media, was the strategic thinker who operated the day-to-day business of the group including its US$50 billion global spending spree.

Questions continue to be raised about the opaque structure of the group which obscures its ultimate owners. It is understood the Hainan Cihang Charity Foundation and the Cihang Foundation own 52.2% of HNA, position that would increase to 67.2% if Wang’s shares are included. The South China Morning Post said the Cihang Foundation is eventually expected to fully own the group, but progress to this status will be a delicate balancing act as the group is so highly leveraged.

“The disposition of the shares in the HNA Group held by Mr. Wang at the time of his death will be addressed in due course, consistent with his pledge to donate them to charity, and in accordance with all appropriate and legal and regulatory guidelines,” HNA Group said in early July. It added it would provide more details of the situation when they were available.

Eighteen months ago, the Chinese government demanded that the HNA Group, along with three other massive Mainland conglomerates, pay down some of its massive debt and curb its appetite for acquisitions.

HNA Group has since sold its interests in diverse investments that have included U.S. commercial property, its Hilton Worldwide Hotel holdings, Hong Kong land and property acquisitions, several aviation-related companies, equity in South American airline, Azul, and most recently, warehouses valued at US$554 million in Singapore. The Singapore properties were owned by a subsidiary of HNA Group, Hong Kong-listed CWT International.

Its airline subsidiaries include 20% plus in Virgin Australia as well as controlling equity in 10 Mainland and Hong Kong airlines, including Hong Kong Airlines and HK Express.

In June, the group received a financial lifeline when China’s Central Bank instructed lenders to support HNA Group bonds, a benefit not bestowed on several other indebted Mainland companies.